The Role of Product Management in Banking App Development

PUBLISHED

22 April, 2024

Growth Manager

Today, banking is all about ease and access. Mobile apps have made managing money simpler. They allow users to send and receive money along with a host of other tools. Product management is key to making these apps great. It handles everything from design to updates, making sure apps meet customer needs.

One study from McKinsey is eye-opening: Banks with top customer experiences grow 46% faster than those with lower ratings. This shows how crucial it is to give users a great app experience. It's not just about happy customers; it's also the key to growing your business.

At UXCam, we understand how product management shapes banking apps' success. As such, we'll share strategies and tips for navigating mobile app development in banking. Join us as we uncover ways to create user-friendly banking apps that boost growth and loyalty in a competitive market.

Why listen to us?

Banking app users crave simplicity and personalized experiences. Through our work with leading brands like Housing.com and Costa Coffee, we've seen firsthand how targeted improvements can significantly increase feature adoption and app registrations.

For instance, Housing.com boosted feature adoption by 20% by refining its search functionality based on insights from UXCam session recordings.

Having helped brands navigate these challenges successfully, we know the positive impact of a well-managed product on user satisfaction and business growth. By focusing on user behavior and making data-driven decisions, we've seen clients not only meet but surpass their growth and loyalty goals.

Helpful summary

Overview: We explore the role of product management in banking app development, focusing on creating apps that meet customer needs, improve user experience, and ensure apps remain competitive and relevant.

Why It Matters: Understanding user experience and gathering insights not only satisfies customers but also drives business growth.

Action Points: Use tools like UXCam for session replay and user journey visualization to identify and address pain points, streamline user journeys, and personalize user experiences.

Further Research: Explore how continuous user feedback and behavior analysis can inform ongoing app improvements to meet evolving customer needs and preferences.

What is product management in banking?

Product management in the banking industry involves overseeing the development and launch of new financial products and services. Product managers play a pivotal role in understanding customer needs, preferences, and behaviors. They conduct market research to identify pain points and gather insights.

The product manager is the main point of contact for creating and executing the bank’s product development roadmap. This roadmap outlines the introduction of new offerings aligned with the bank’s growth goals.

Lastly, product management ensures that banks remain relevant by adapting to rapidly changing customer demands and market dynamics.

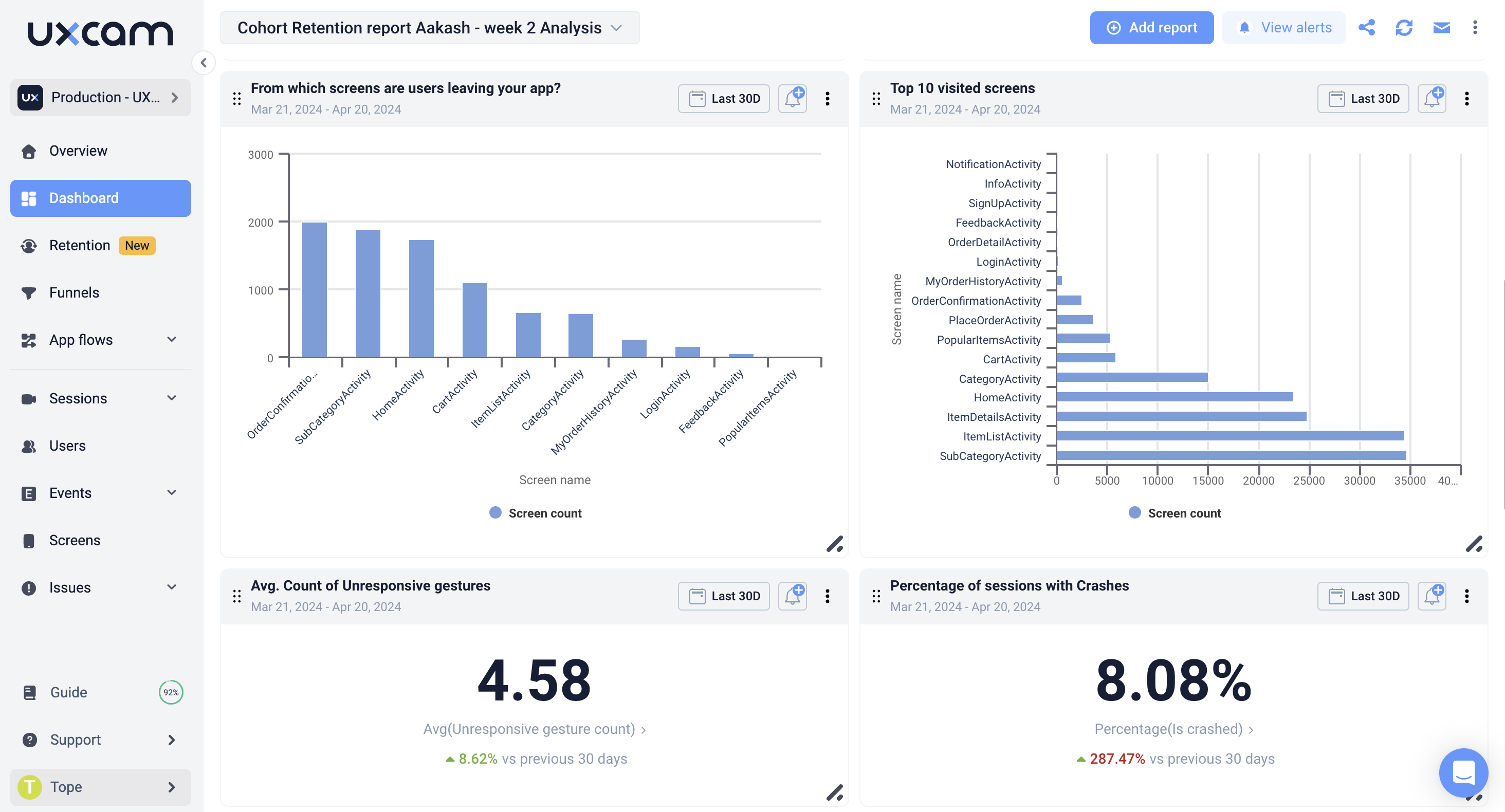

Tools like UXCam can come in handy for tracking user behavior and improving the overall customer experience.

For example, we provide session replay and user journey visualization. Product managers can observe how users interact with the banking app, identifying pain points, bottlenecks, and areas for improvement.

Why product management in banking app development is important

Meet customer needs

More than 70% of customers from the four major US banks use mobile banking apps, with Bank of America's app alone having 29 million users globally.

Product managers in banking are tasked with understanding customer needs through market research, defining product strategies, and working with cross-functional teams to develop products that compare favorably with the competition.

Enhance customer experience and engagement

Let’s face it, since there are so many mobile banking apps, it’s difficult to separate yourself from the pack. By making it as convenient and simple as possible for your users to manage their finances, you’re distinguishing your app from the rest.

Not to mention, your app serves as an additional marketing channel, enabling banks to communicate directly with customers through features like push notifications.

A noteworthy example is BNP Paribas, which saw a 60% increase in its app store rating to 4 stars after implementing targeted push notifications.

Product management strategies for banking app development

Step 1: Understand your users

The first step in boosting growth and loyalty is to understand your users' needs, preferences, and pain points. By gaining insights into these aspects, you pave the way for more effective strategies tailored to their specific needs.

UXCam can help you gain a deeper understanding of how users interact with your banking app by providing session recordings, heatmaps, and user flow analysis.

For example, you can use UXCam to identify which features users engage with the most and which ones they struggle with. This information can help you prioritize improvements and create a more user-centric app.

Step 2: Simplify the user journey

A complex user journey can lead to frustration and abandonment.

How do you simplify it?

Remove unnecessary steps, improve navigation, and provide clear instructions at every stage of the process.

Use UXCam to analyze user flows and identify areas where users drop off or encounter friction. For instance, if you notice that many users abandon the app during the account creation process, you might want to reduce the number of steps required or provide clearer instructions.

Step 3: Personalize the experience

Personalization is key to creating a loyal user base. By adapting your approach to cater to the specific needs and preferences of each user, you make them feel valued and appreciated. You create a more meaningful connection with your audience, leading to increased satisfaction and long-term commitment

Use UXCam to segment your users based on their behavior and preferences, and tailor the app experience accordingly. For example, you can use UXCam to identify users who frequently use the bill payment feature and send them personalized recommendations for new billers or payment options.

Step 4: Optimize for performance

When it comes to developing an application, optimal performance is the bare minimum.

An app that runs slowly or has bugs can easily turn users away due to frustration and dissatisfaction.

Use UXCam to monitor app performance and identify areas for improvement. For instance, if you notice that certain screens take longer to load, you can optimize the code or reduce the size of images to improve performance.

Step 5: Continuously literate and improve

Product management is an ongoing process, and you must continuously iterate and improve your banking app based on user feedback and behavior.

Use UXCam to track key metrics such as user retention, engagement, and conversion rates, and use this data to inform your product roadmap. For example, if you notice that a new feature is not being used as much as expected, you can use UXCam to understand why and make necessary improvements.

Conclusion

In an era where convenience and accessibility are paramount, mobile banking apps serve as indispensable tools for customers worldwide.

Through effective product management, banks can not only meet the evolving needs of their customers but also drive significant growth and foster loyalty in a highly competitive market.

Favoring user-centric design will contribute substantially to your app’s success. By leveraging tools like UXCam, you can gain valuable insights into user behavior, allowing for informed decision-making and targeted improvements throughout the development process. Try UXCam today for free.

You might also be interested in these;

A guide to Finance product management

Finance apps have a customer support problem, here's how to fix it

7 Ways to increase FinTech app account activation

8 low-effort high-impact fintech mobile app improvements

A practical guide to mobile app product management

12 KPIs to measure and improve your FinTech app onboarding strategy

AUTHOR

Tope Longe

Growth Manager

Ardent technophile exploring the world of mobile app product management at UXCam.

Get the latest from UXCam

Stay up-to-date with UXCam's latest features, insights, and industry news for an exceptional user experience.

Related articles

Product Management

5 Best Product Experience Software and Tools

Explore the top 5 product experience software and tools to elevate user satisfaction. Find the perfect solutions for optimizing conversions and boosting business...

Tope Longe

Growth Manager

Product best practices

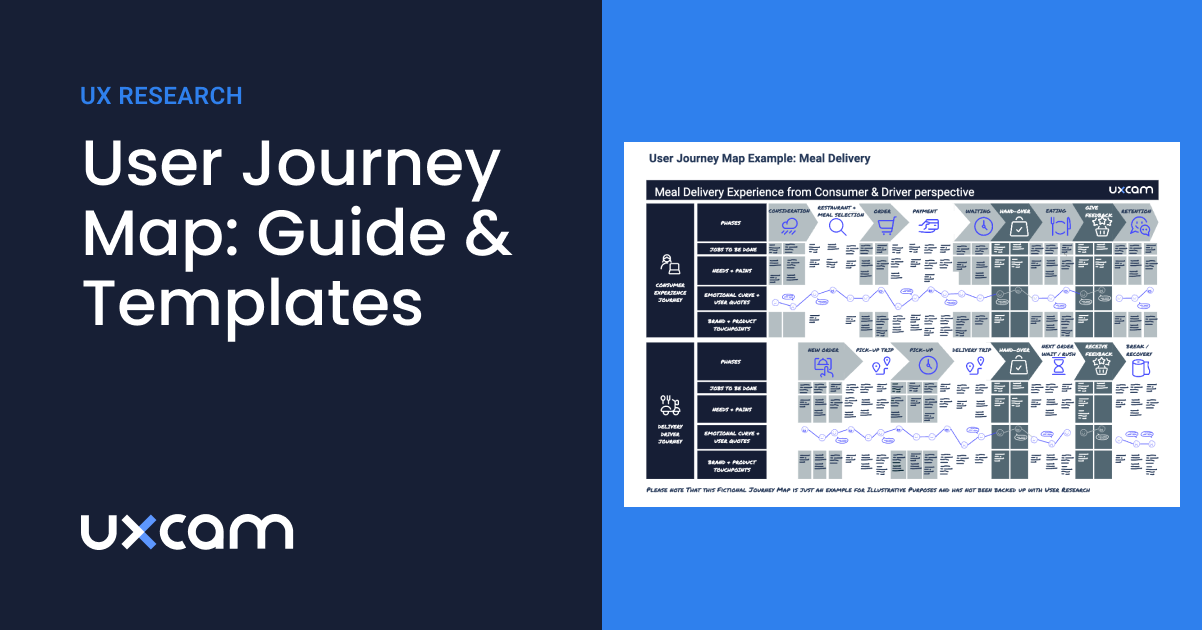

User Journey Map Guide with Examples & FREE Templates

Learn experience mapping basics and benefits using templates and examples with mixed-methods UX researcher Alice...

Alice Ruddigkeit

Senior UX Researcher

Session Replay

Mobile Session Recording: The Complete Guide 2024

Why session replay is such a valuable feature, and what you should look out for when starting...

Annemarie Bufe

Content Manager