Finance apps have a customer support problem, here's how to fix it

PUBLISHED

28 February, 2023

Content Director

When it comes to the mobile fintech industry, the speed and effectiveness of customer support can be a determining factor in whether you win or lose. With mobile financial services, customers can choose different channels of support whether it be chatbots, phone, email, or live chat. But due to the rapid growth of the industry, fintech is facing a customer support problem.

The traditional banking industry took decades to develop sophisticated customer support systems, and banking on mobile only exploded in the past decade worldwide. With the global growth rate of the fintech market reaching nearly $700 billion by 2030, the industry must keep up with the demand of customer support.

In one survey of digital banking customers, 64% of respondents felt that their bank’s mobile app did not allow them to solve a customer service question quickly—if at all. But time to resolve is one of the most crucial aspects — the perceived risk is extremely high as you’re one step from a customer speaking on a public forum saying your app is a scam or that their money was stolen. This could easily be avoided by faster time to resolve an issue.

That’s why automating your error detection and connecting your user behavior and experience analytics directly with your customer success team will be a key to winning mobile customers in the fintech space.

How fintech apps can offer outstanding customer service

An outstanding customer support experience can give customers the same trust, accessibility, and familiarity of a traditional bank. Customer success teams in fintechs need to:

React fast. Users having issues with the app won’t have a lot of patience waiting for a solution.

Identifying what the issue is quickly and communicating with the user either on how to solve the issue themselves, or how the team will be making a fix in the future.

Integrate support tools to manage tickets and solve issues fast.

Prepare FAQs so users can get answers themselves, lowering ticket volume.

Identify and effectively communicate common or recurring issues to product teams so they can work on long-term solutions and improve churn rates.

Have dedicated account managers for high-touch clients who need a different level of relationship management than the average customer.

Track and measure everything. Only with the accurate user behavior data will you be able to properly identify user pain points and resolve issues quicker.

Overcoming the core CS challenges in fintech

Not only is there a lot of competition in the fintech app space, but users are also more fickle about the apps they use. The variety of fintech companies to choose from continues to grow, and so your differentiators become crucial to stay relevant.

Not working on building a strong and capable customer success team from the beginning will affect churn, retention, engagement, and ARR if users don’t trust how their data and finances are being handled. Trust, customer success, and user experience are tightly linked.

Here are 4 areas fintech apps struggle in to deliver customer success and how to resolve them:

Reducing feedback loops and scaling support

One of the biggest causes of delay in getting support is users communicating the problem to CS to begin with. Users sometimes struggle to express themselves to customer support agents. During a chat or call, frustrated users may:

Not be able to explain the situation as it happened

Not remember the situation for the agent to replicate

Have the language ability to make their situation clear

Be emotionally driven and impatient

Lack the technical language or knowledge to express themselves

Not trusting agents with sensitive identifiable personal information, therefore not giving access to sharing a screen

Besides communication issues, there may also be personal issues. Users may not be telling the whole truth about the steps they took that lead to an error. In financial products, users may give untrue information when applying for a credit card, then reverse their selection after they get denied, and try again. Fraud detection on your app could be flagging the issue and this is why they can’t continue with their process. Unreliable reporting into a customer problem can significantly delay time to resolution.

Here’s our recommendation to solve this.

Part 1: Give the support agents full context

If agents have the power to replay the user sessions on the app right after the user submitted the ticket, they’ll have the full context of the user experience and they can get to the bottom of the issue without even having to speak to the user. Once the user is in the chat or call, the agent can already see what happened.

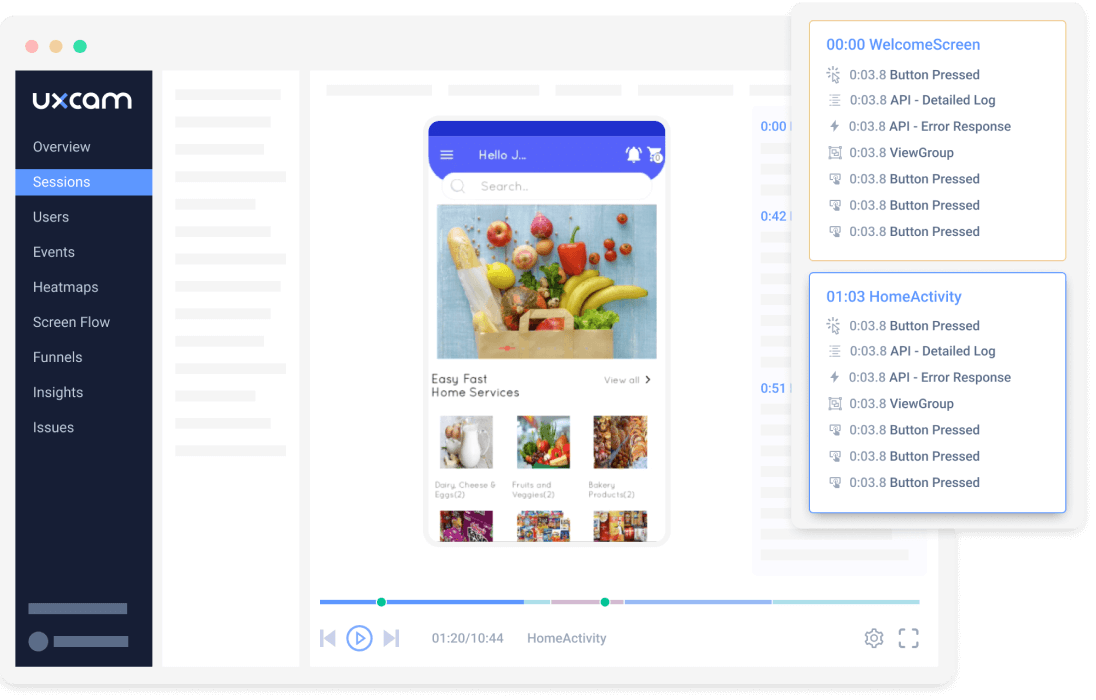

On UXCam, session replays are automatically logged upon installation so all sessions are recorded and information on each session can be tagged, commented, and shared with other teams.

UXCam's session replays.

Part 2: Integrate mobile user behavior solutions into customer success tools.

Product managers or customer success agents can directly integrate UXCam’s session replays with their CRM like Salesforce, Intercom, Zendesk, and link your user sessions with support tickets. You’ll be able to tag, comment, and share the exact session problem to your CS team.

Specialists on the customer experience side will be able to easily navigate to the session linked to the support ticket. You can also review the technical app logs — which are all auto captured.

Once your CX team has opened up the session, they can see everything that happened. They’ll get the full technical logs such as:

Debug

Error

Fault

Undefined

Warning

Integrating UXCam into your engineering workflow will also shorten feedback loops. By giving engineers the full context of crashes and issues, you’ll be able to directly navigate to the problem screens. Engineers, in addition to CS, can watch session replays and replicate issues like bug crashes, UI freezes, and handled exceptions. A simple Slack integration can alert your engineering team of issues which can be resolved quickly.

This can significantly reduce the response time and increase customer delight due to the speed of response and resolution.

Example of UXCam and Intercom integration.

Drop off during Know Your Customer (KYC) process

‘Know your customer’, or KYC, is a process ensuring the prevention of fraud and financial crime and is one of the most critical factors in fintech product development. It can also be a bottleneck in onboarding. Over 50% of customers applying for digital services such as online bank accounts quit before completion.

This is one of the stages where users can feel frustrated due to the technical limitations of a human-less KYC process. The primary reason for KYC abandonment is a lengthy application process and the amount of documentation and information users need to provide.

At UXCam, we’ve seen customers of our mobile payment clients struggle with the KYC process. We investigated their onboarding and saw that customers usually complete their onboarding in more than one session. It’s likely that they got distracted or needed to leave to get data such as a passport or identification card. Through session replays we noticed a few anomalies:

Users rush through the process without reading all the instructions

The biometric evaluation of the app was buggy and needed to be fixed

For the facial recognition part of the KYC, users needed to be told to get in a good position and to look in the camera

Not all users understood the instructions on how to take a photo

Users needed a lot of guidance on how to upload a piece of government ID

Users were rushing through the process and uploading with errors

How to solve it

Issues with onboarding begin with the product and design team and often end with customer support resolving issues in the product. We believe that this process can be improved if customer support teams had the power to analyze onboarding data and influence product development. Currently product decisions sit with product teams and design is based on user requirements — not based on CS or CX teams.

With UXCam, customer experience teams can prevent KYC issues at a more proactive, higher level - not just as they occur. By using UXCam to segment different groups of users during their KYC process, CS teams will be able to build hypotheses as to how to improve the process. They can segment users by those who are:

Have issues with a problematic screen

Dropping off on this part of the journey (% of users)

Experiencing purely technical issues

Just do not understand how to follow instructions

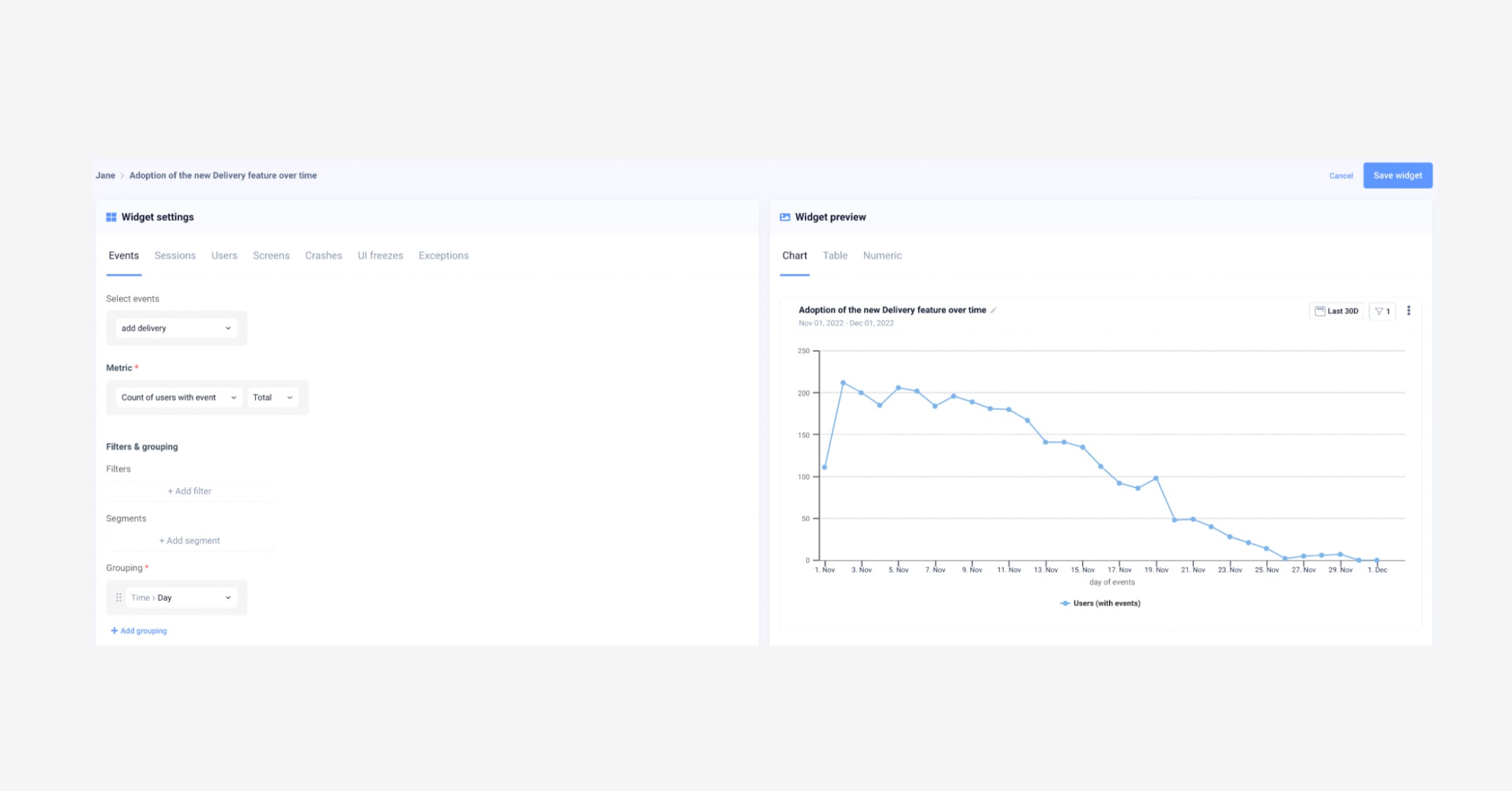

CX teams can back up their visual evidence samples with trend data which could help them move the needle with the product and make changes that can prevent user frustrations. With strong enough evidence, they will be able to tell product teams that change is required in the app.

Adoption of a new delivery feature over time on UXCam (click to enlarge).

Lack of education on new features and offerings

As personal stock trading apps learned in the early 2010s — it’s easy to overestimate the customer’s knowledge of how to use their apps. As previously gated financial offerings such as crypto and stock trading become free for the public to use, education has become critical to both the business and the personal livelihood of the user.

Most companies assume that users will know how to use their apps intuitively. Although many of your native digital audience, like those from Gen-Z or Millennials, will grasp concepts fairly quickly, a lot more will need some hand-holding and guidance.

A single misstep can make an unwanted transaction, that’s why it�’s important to track the adoption of new features.

How to solve this

Tracking the release of your new features and optimizing for better engagement and adoption will save your product and customer success teams time and resources.

Let’s say you’ve just released a new stock trading feature on your digital bank and want to see if customers are using it or using it correctly. Set up custom events for the usage of this specific feature, here are examples:

Opened the new feature — this could be just a screen

Engaged with certain sections of the feature

Completed a [specific] transaction on the app

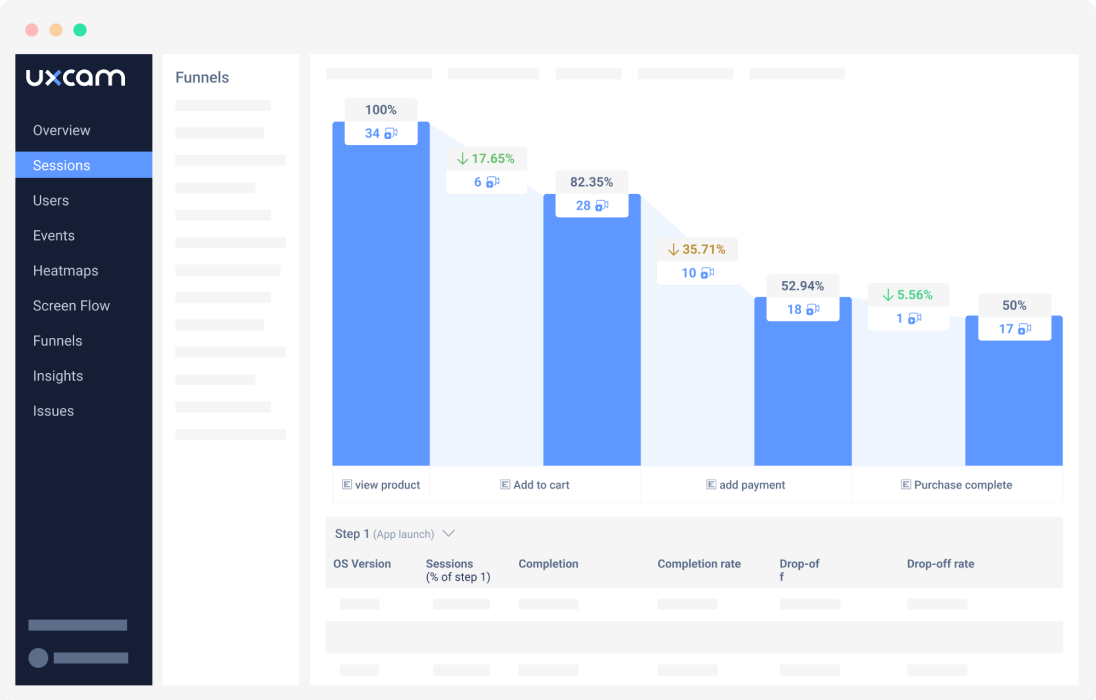

Now that you have events, you can create feature adoption funnels based on different versions of your app. You can manually create segments based on:

Users who were exposed to the new feature but never used it

Users who clicked on a new feature once and never again

Users who used it repeatedly over a 7, 10, 30 or 90 day period

Users who use the feature daily

Users who didn't use the app at all.

Based on the analysis of specific user segments, you can create and validate hypotheses as to why users are not fully adopting new features. Maybe they are not leaving support tickets at all or are just confused by the app UX.

Customer support teams can use this data to improve the guides or FAQs of a new feature. If they see that people are not adopting, they can also watch session replays to better understand the most confusing part and educate users on it.

With this info, content teams can create in-depth self-support content within the app. This could be how-to guides, help center documentation, or pop-up communications in-app to guide users through unexplored areas or features. Revolut creates articles like this to explain what the KYC process is and why they need documentation.

CS and CX teams can further provide feedback to the product and UX teams to tell them that adoption is low and to test their hypotheses.

Example of the funnel feature on UXCam.

Privacy challenges and solutions with analytics and fintech apps

In this article, we’ve mentioned session replays quite a lot. We know that privacy and security is a top priority with all fintech solutions. That’s why we’re one of the rare mobile app analytics products out there that offer customized blurring and occlusion of sensitive information.

In order to still see where the user's finger is moving on the screen — yet protect sensitive information, we give you the power to control the radius of certain parts of the screen. We enable you to completely block or blur PII data such as credit card information and home addresses.

Privacy and customer success should be a part of your mobile fintech journey — not an afterthought. By building your app with the customer’s safety and peace of mind as a priority, you’ll stand out amongst the crowd.

Related Articles

AUTHOR

Jane Leung

Content Director

Jane is the director of content at UXCam. She's been helping businesses drive value to their customers through content for the past 10 years. The former content manager, copywriter, and journalist specializes in researching content that helps customers better understand their painpoints and solutions.

What’s UXCam?

Related articles

Product best practices

Como Encontrar Usuários Ativos De Um Aplicativo

Descubra estratégias comprovadas para identificar e engajar usuários ativos do seu app, aumentar a retenção, impulsionar o crescimento e maximizar o sucesso do seu...

Tope Longe

Growth Marketing Manager

Product best practices

Product Performance Analysis - A 7-Step Playbook with UXCam

Learn how to use product performance analysis to improve UX, boost retention, and drive growth with actionable steps and...

Tope Longe

Growth Marketing Manager

Product best practices

How to Increase Mobile App Engagement (10 Key Strategies)

Discover the top strategies for increasing mobile app engagement and user retention. From push notifications to app gamification, our expert tips will help you boost...

Tope Longe

Growth Marketing Manager